Links And Books

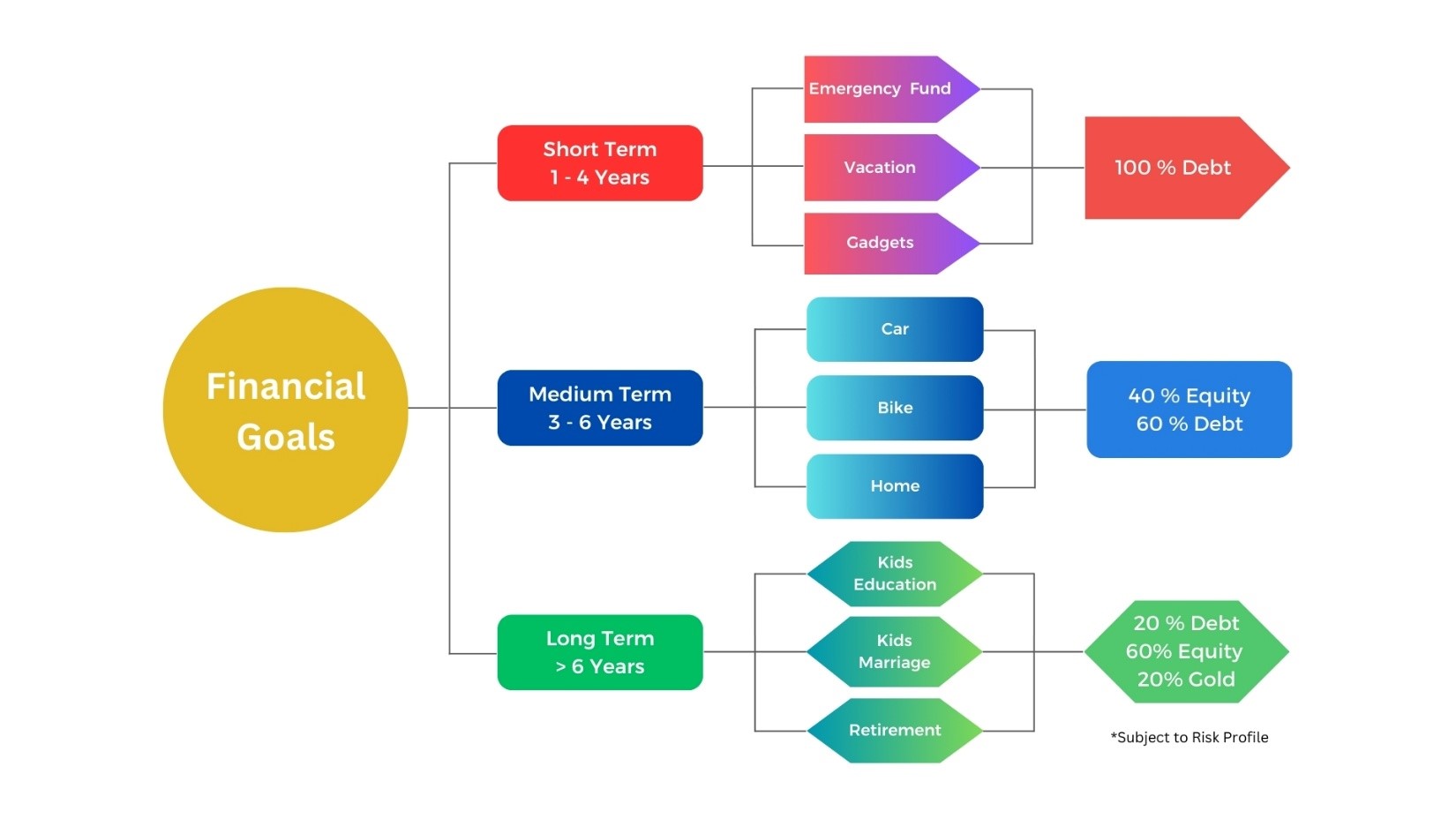

Step 1 : Financial Goals

Our goal segregation into short-term, medium-term, and long-term categories is based on general planning principles and may vary depending on individual circumstances. These classifications are meant to serve as a guideline and should be adapted to your specific needs and priorities. We encourage users to regularly review and adjust their goals as necessary

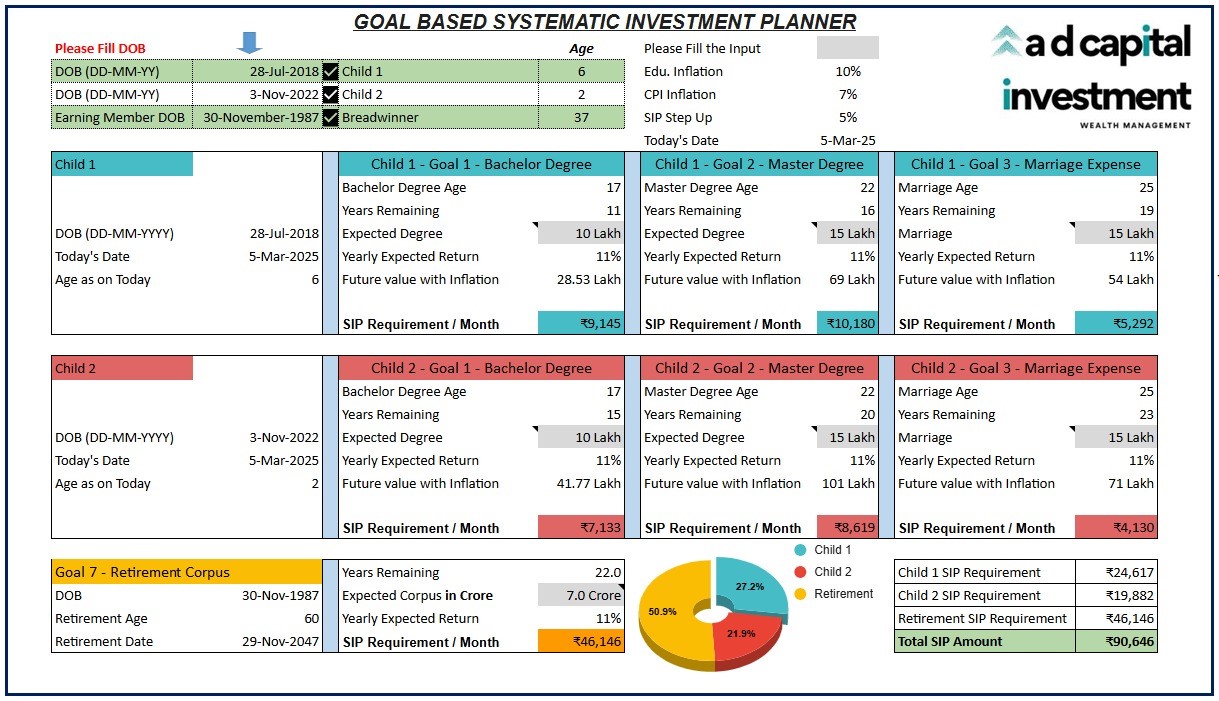

Step 2 : Comprehensive Goal Planner

A goal planner provides clarity and focus, helping you prioritize and manage your time efficiently. It boosts motivation by tracking progress and creates accountability to stay on track. Additionally, it reduces stress by offering a clear roadmap and aids in informed decision-making. Overall, it fosters personal and professional growth.

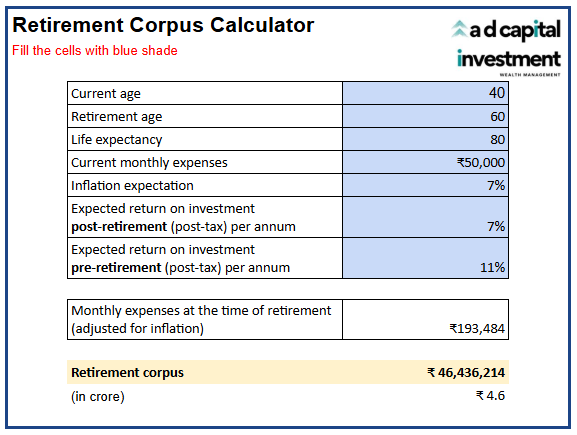

Step 3 : Retirement Corpus Calculator

Retirement ensures financial security and a peaceful life after years of hard work. It boosts overall well-being by allowing time for hobbies, family, and personal growth. It also creates job opportunities for younger generations, supporting economic stability.

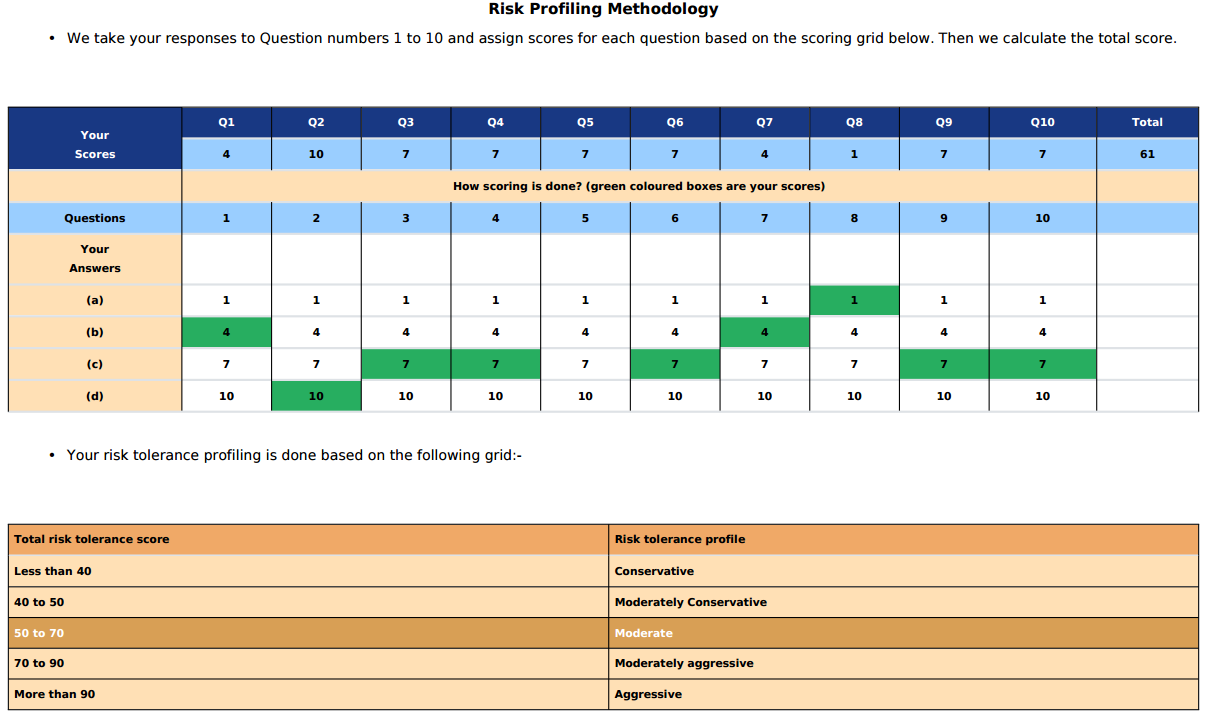

Step 4 : Customer Risk Analysis

Risk analysis helps investors identify potential pitfalls and evaluate the likelihood of financial loss. It allows for informed decision-making, ensuring investments align with one's risk tolerance and financial goals. Ultimately, it aims to maximize returns while minimizing unforeseen setbacks.

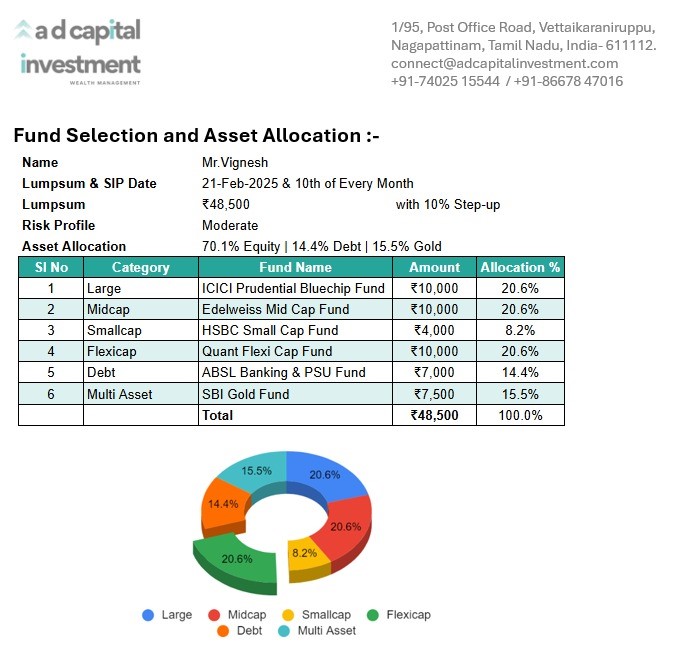

Step 5 : Asset Allocation & Fund Selection

Asset allocation diversifies investments, reducing risk and potential losses. It ensures that your portfolio aligns with your risk tolerance and financial goals. By strategically allocating assets, you aim to maximize returns while minimizing volatility.

Step 6: Initiate the SIP with Step-up

We will initiate the SIP after client approval. Clients have multiple options to track their portfolios via web and app login methods (iOS & Android), ensuring smooth navigation.

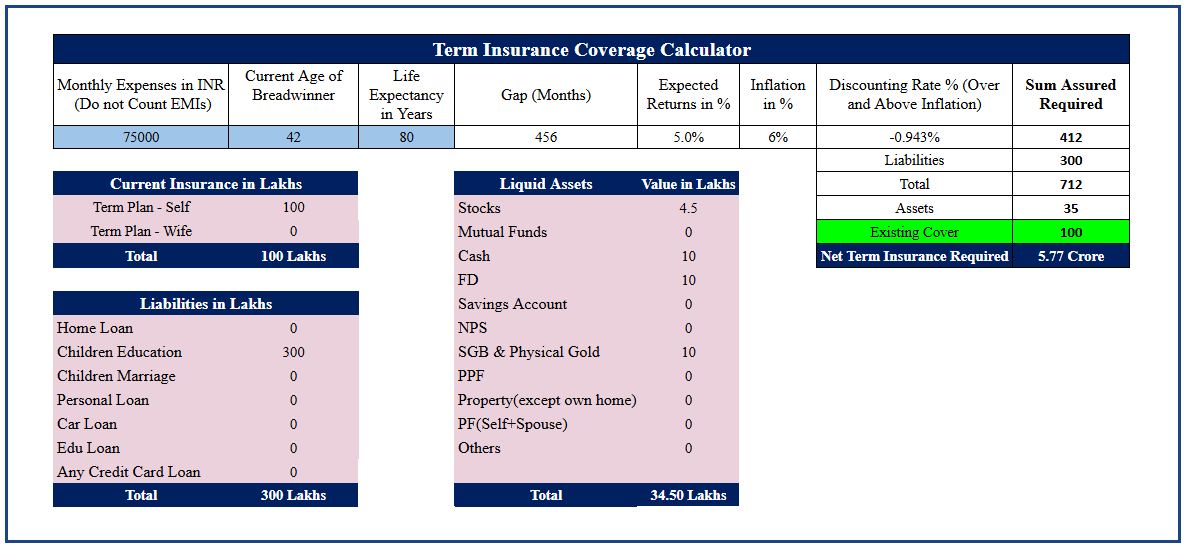

Step 7 : Term Insurance Calculator

Term insurance offers financial protection for your family in case of your untimely death, ensuring they are taken care of. It's affordable and provides peace of mind, knowing your loved ones are secure. Additionally, term insurance offers flexible coverage options to fit your needs. Overall, it's a practical way to safeguard your family's future.